Investment Pools

T. Rowe Price Charitable's investment pools are composed of mutual funds managed by T. Rowe Price, a world-class investment manager focused on delivering strong returns over time. The investment objectives of the nine pools range from capital preservation to aggressive growth. All pools are subject to market risk, including possible loss of principal.

You can invest in one or a combination of these pools. Requests to reallocate your giving account balance can be submitted at any time with no fees.

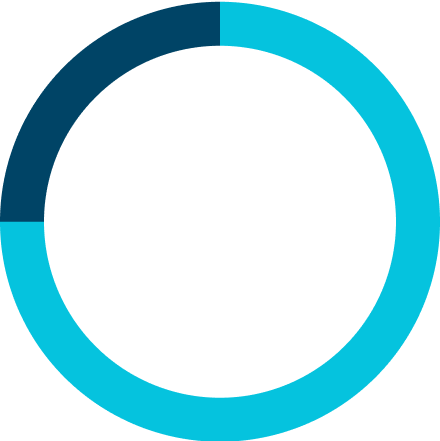

Gift Preservation Pool

Seeks the preservation of capital and an attractive level of income consistent with minimal fluctuation in principal value and liquidity through a mix of a short-term bond fund and a government money market fund. The value of the pool and its yield will vary with interest rate changes and other market conditions.

- 75% Short Term Bond Fund – I Class

- 25% US Treasury Money Fund

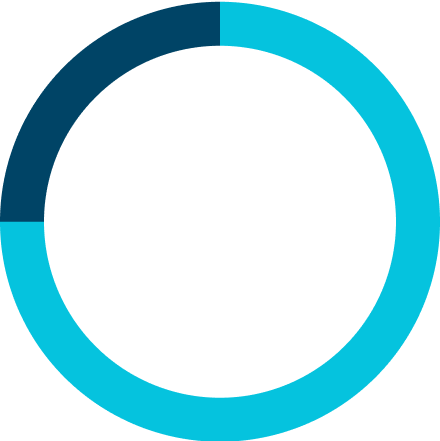

Gift Preservation Pool

Seeks the preservation of capital and an attractive level of income consistent with minimal fluctuation in principal value and liquidity through a mix of a...

Seeks the preservation of capital and an attractive level of income consistent with minimal fluctuation in principal value and liquidity through a mix of a short-term bond fund and a government money market fund. The value of the pool and its yield will vary with interest rate changes and other market conditions.

- 75% Short Term Bond Fund – I Class

- 25% US Treasury Money Fund

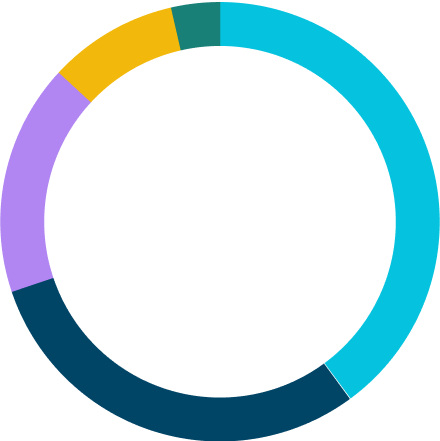

Diversified Income Pool

Provides a higher income-oriented option than the Gift Preservation Pool with some capital appreciation potential through a 60%/40% fixed income/equity allocation. The pool primarily invests in funds that hold fixed income instruments and income-oriented stocks paying high dividends.

- 60% Spectrum Income Fund – I Class

- 19% Equity Income Fund – I Class

- 19% Balanced Fund – I Class

- 2% Real Assets Fund – I Class

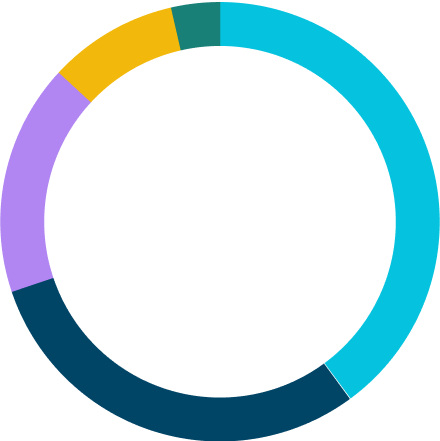

Diversified Income Pool

Provides a higher income-oriented option than the Gift Preservation Pool with some capital appreciation potential through a 60%/40% fixed income/equity...

Provides a higher income-oriented option than the Gift Preservation Pool with some capital appreciation potential through a 60%/40% fixed income/equity allocation. The pool primarily invests in funds that hold fixed income instruments and income-oriented stocks paying high dividends.

- 60% Spectrum Income Fund – I Class

- 19% Equity Income Fund – I Class

- 19% Balanced Fund – I Class

- 2% Real Assets Fund – I Class

Balanced Index Pool

Uses a passive investment approach to provide a combination of moderate income, some long-term growth potential, and access to foreign markets. It also benefits from the lower fees inherent in a passive investment approach.

- 40% U.S. Bond Enhanced Index Fund

- 29.9% Equity Index 500 – I Class

- 17.1% International Equity Index Fund

- 10% Extended Equity Market Index Fund

- 3% Real Assets Fund – I Class

Balanced Index Pool

Uses a passive investment approach to provide a combination of moderate income, some long-term growth potential, and access to foreign markets...

Uses a passive investment approach to provide a combination of moderate income, some long-term growth potential, and access to foreign markets. It also benefits from the lower fees inherent in a passive investment approach.

- 40% U.S. Bond Enhanced Index Fund

- 29.9% Equity Index 500 – I Class

- 17.1% International Equity Index Fund

- 10% Extended Equity Market Index Fund

- 3% Real Assets Fund – I Class

Moderate Growth Pool

Combines a mix of both domestic and international stocks while seeking diversification through holdings in a well-balanced bond fund.¹ The pool manages volatility through a combination of stock funds that have the potential for gaining high returns in domestic and international equity and bond markets.

- 30% Spectrum Income Fund

- 15.2% Growth Stock Fund - I Class

- 15.2% Equity Income Fund - I Class

- 8.55% Int’l Stock Fund - I Class

- 8.55% Int’l Value Equity Fund - I Class

- 5.45% Equity Index 500 Fund - I Class

- 5% Small-Cap Stock Fund - I Class

- 2.85% Emerging Markets Stock Fund - I Class

- 3.5% Real Assets Fund - I Class

- 2.85% Mid-Cap Growth Fund - I Class

- 2.85% Mid-Cap Value Fund - I Class

Moderate Growth Pool

Combines a mix of both domestic and international stocks while seeking diversification through holdings in a well-balanced bond fund.¹ The pool manages...

Combines a mix of both domestic and international stocks while seeking diversification through holdings in a well-balanced bond fund.¹ The pool manages volatility through a combination of stock funds that have the potential for gaining high returns in domestic and international equity and bond markets.

- 30% Spectrum Income Fund

- 15.2% Growth Stock Fund - I Class

- 15.2% Equity Income Fund - I Class

- 8.55% Int’l Stock Fund - I Class

- 8.55% Int’l Value Equity Fund - I Class

- 5.45% Equity Index 500 Fund - I Class

- 5% Small-Cap Stock Fund - I Class

- 2.85% Emerging Markets Stock Fund - I Class

- 3.5% Real Assets Fund - I Class

- 2.85% Mid-Cap Growth Fund - I Class

- 2.85% Mid-Cap Value Fund - I Class

Growth Pool

Seeks long-term capital appreciation by broadly investing in mutual funds focused on both domestic and international equity markets.¹ This pool's strategy is based on the understanding that the volatility associated with equity markets also offers the greatest potential for long-term capital appreciation.

- 20.45% Growth Stock Fund - I Class

- 20.45% Equity Income Fund - I Class

- 12.1% Int’l Stock Fund - I Class

- 12.1% Int’l Value Equity Fund - I Class

- 10.2% Equity Index 500 Fund - I Class

- 7.35% Small-Cap Stock Fund - I Class

- 5% Real Assets Fund - I Class

- 4.25% Emerging Markets Stock Fund - I Class

- 4.05% Mid-Cap Growth Fund - I Class

- 4.05% Mid-Cap Value Fund - I Class

Growth Pool

Seeks long-term capital appreciation by broadly investing in mutual funds focused on both domestic and international equity markets.¹ This pool's...

Seeks long-term capital appreciation by broadly investing in mutual funds focused on both domestic and international equity markets.¹ This pool's strategy is based on the understanding that the volatility associated with equity markets also offers the greatest potential for long-term capital appreciation.

- 20.45% Growth Stock Fund - I Class

- 20.45% Equity Income Fund - I Class

- 12.1% Int’l Stock Fund - I Class

- 12.1% Int’l Value Equity Fund - I Class

- 10.2% Equity Index 500 Fund - I Class

- 7.35% Small-Cap Stock Fund - I Class

- 5% Real Assets Fund - I Class

- 4.25% Emerging Markets Stock Fund - I Class

- 4.05% Mid-Cap Growth Fund - I Class

- 4.05% Mid-Cap Value Fund - I Class

Global Equity Pool

Focuses heavily on developed and emerging markets around the globe to pursue long-term capital growth. Invests in mutual funds that seek to identify established and emerging companies with solid prospects. The pool takes a flexible approach—it invests in domestic and international equity markets, looking for growth and value stocks across all market capitalizations. International investing is subject to unique risks, including risks associated with unfavorable currency exchange rates and political or economic uncertainty abroad.

- 22.3% Global Stock Fund - I Class

- 12.35% Int’l Value Equity Fund - I Class

- 16.6% International Equity Index Fund

- 14.5% Equity Index 500 Fund - I Class

- 9.95% Emerging Markets Stock Fund - I Class

- 11.15% Value Fund - I Class

- 5% Real Assets Fund - I Class

- 3.35% Small-Cap Stock Fund - I Class

- 2.4% Mid-Cap Growth Fund - I Class

- 2.4% Mid-Cap Value Fund - I Class

Global Equity Pool

Focuses heavily on developed and emerging markets around the globe to pursue long-term capital growth. Invests in mutual funds that seek to identify...

Focuses heavily on developed and emerging markets around the globe to pursue long-term capital growth. Invests in mutual funds that seek to identify established and emerging companies with solid prospects. The pool takes a flexible approach—it invests in domestic and international equity markets, looking for growth and value stocks across all market capitalizations. International investing is subject to unique risks, including risks associated with unfavorable currency exchange rates and political or economic uncertainty abroad.

- 22.3% Global Stock Fund - I Class

- 12.35% Int’l Value Equity Fund - I Class

- 16.6% International Equity Index Fund

- 14.5% Equity Index 500 Fund - I Class

- 9.95% Emerging Markets Stock Fund - I Class

- 11.15% Value Fund - I Class

- 5% Real Assets Fund - I Class

- 3.35% Small-Cap Stock Fund - I Class

- 2.4% Mid-Cap Growth Fund - I Class

- 2.4% Mid-Cap Value Fund - I Class

Total Equity Market Index Pool

Seeks to match the performance of the entire U.S. stock market by investing substantially in a broad spectrum of small-, mid-, and large-cap stocks representative of the S&P Total Market Index.

- 100% Total Equity Market Index Fund

Total Equity Market Index Pool

Seeks to match the performance of the entire U.S. stock market by investing substantially in a broad spectrum of small-, mid-, and large-cap stocks representative of the S&P Total Market Index.

Seeks to match the performance of the entire U.S. stock market by investing substantially in a broad spectrum of small-, mid-, and large-cap stocks representative of the S&P Total Market Index.

- 100% Total Equity Market Index Fund

International Equity Index Pool

Provides long-term capital growth by seeking to match the performance of the FTSE All World Developed ex North America Index, an equity market index based on the market capitalization of over 1,000 predominately large companies listed in Japan, the U.K., and developed countries in Continental Europe and the Pacific Rim.

- 100% International Equity Index Fund

International Equity Index Pool

Provides long-term capital growth by seeking to match the performance of the FTSE All World Developed ex North America Index, an equity market index based on the market capitalization of over 1,000 predominately large companies listed in Japan, the U.K., and developed countries in Continental Europe and the Pacific Rim.

Provides long-term capital growth by seeking to match the performance of the FTSE All World Developed ex North America Index, an equity market index based on the market capitalization of over 1,000 predominately large companies listed in Japan, the U.K., and developed countries in Continental Europe and the Pacific Rim.

- 100% International Equity Index Fund

International Equity Pool

Seeks long-term capital appreciation by investing in an allocation across a broad spectrum of stock and, to a lesser degree, bond funds that have holdings in a range of developed and emerging market countries, and in both large and small companies.

- 100% Spectrum International Fund

International Equity Pool

Seeks long-term capital appreciation by investing in an allocation across a broad spectrum of stock and, to a lesser degree, bond funds that have holdings in a range of developed and emerging market countries, and in both large and small companies.

Seeks long-term capital appreciation by investing in an allocation across a broad spectrum of stock and, to a lesser degree, bond funds that have holdings in a range of developed and emerging market countries, and in both large and small companies.

- 100% Spectrum International Fund

1 Diversification cannot assure a profit or protect against loss in a declining market.

T. Rowe Price Charitable's Board of Directors has ultimate authority over investment allocations.

Request a prospectus for any of the funds in which the pools are invest by calling 1-800-564-1597. Prospectuses include investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing.

An investment in a money market fund is not insured or guaranteed by the FDIC or any other government agency. Although it seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.